Reframing the educational journey

Case study Modernist Studio

Our client wanted to better understand how prospects learn about purchasing life insurance and identify opportunities to support that journey. I was hired onto this project to facilitate user research, identify concepts for new products and services, and to help envision and design a solution.

User Research & Systems Design

2018

Problem

Choosing a life insurance policy is a high anxiety, low frequency decision. Our client identified their need to forge a better sense of what information, questions, and content would educate and support prospects in making this decision.

Goal

To understand how to drive prospects to our client’s website as early in their educational journey as possible, and once they are there, to support the education and engagement to connect with an agent.

Skills

User Research

Competitive Analysis

Journey Mapping

Insight Development

Concept Sketching

Systems Design

Wireframing

____

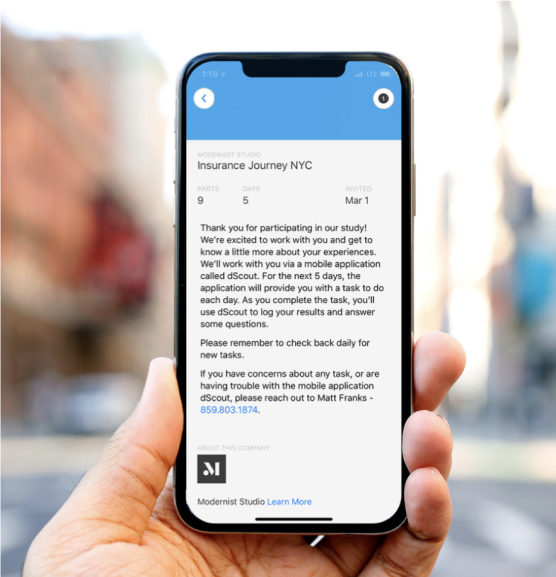

Dscout

Sketch

Marvel

Team

Matt Franks

Jan – Mar 2018

Overview

Our goal was to better understand how people experience the “getting started” part of the life insurance purchasing process. Through design research, synthesis, customer journey mapping, and concept testing, we sought to understand prospects' wants, needs, and desires, and to conceive and structure digital interactions that would support them along their journey.

Discovery phase

Prior research conducted by our client had already established the problem and suggested a recommendation, but questions remained as how to best take action against these prior observations. Here were some of the questions we were considering:

Q:

How do customers frame “the beginning” of the journey?Q:

Who or what (if anyone) is effectively bridging this initial gap?Q:

When might a prospect feel the need for human connection?Q:

What are the types of touch-points that create a sense of forward progress/ momentum?Diary Study

In order to answer these questions, we conducted a Diary Study, tasking 16 participants with various activities to learn about life insurance before interviewing them in person regarding their experience. Our goal was to:

1. See how people manage the self-discovery of life insurance in flows, manage self-directed education, find plans that are right for them, and initiate “the appropriate next steps” towards purchase.

2. Identify places where the process can be improved through new digital interactions, features, or design changes.

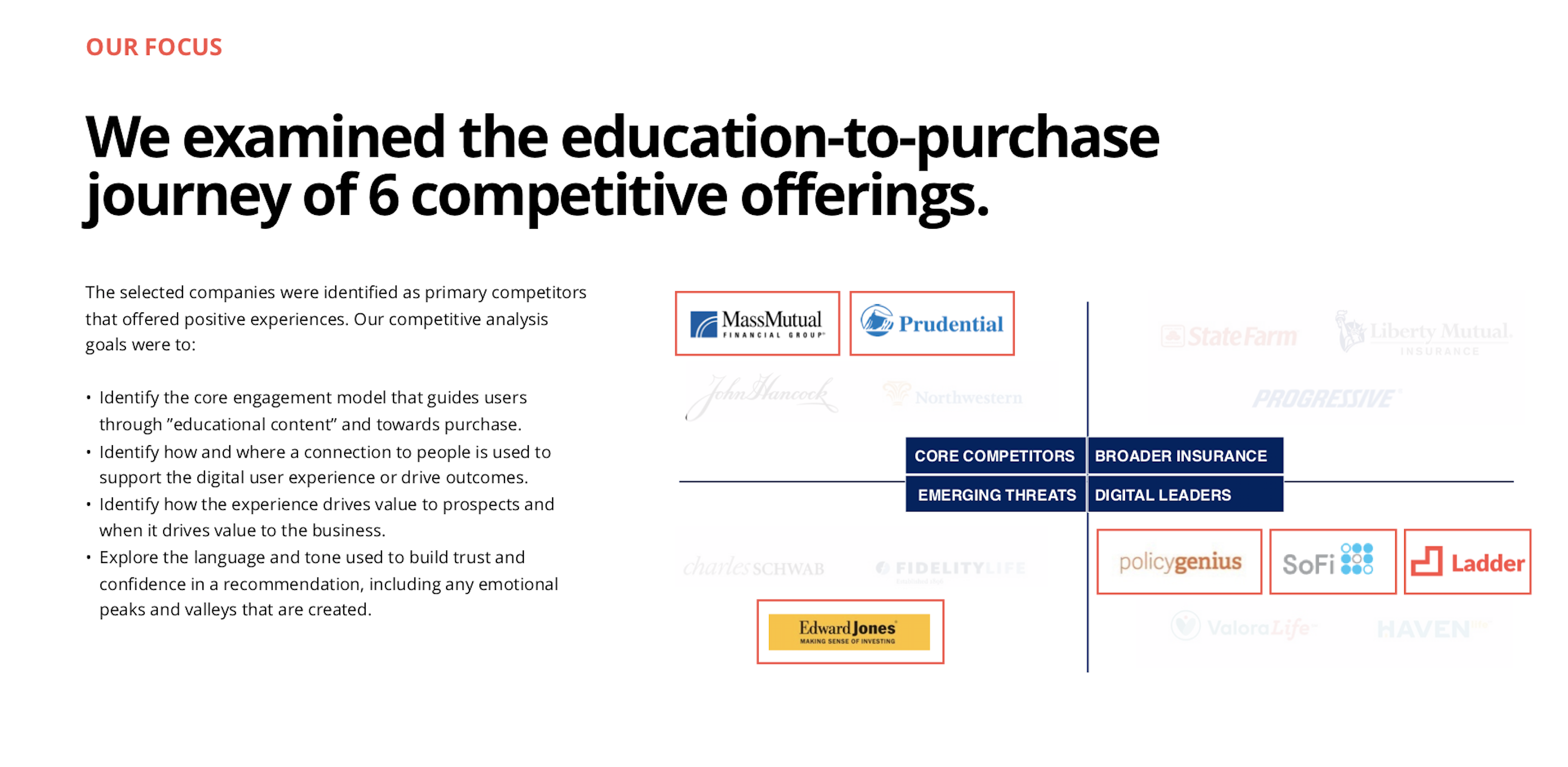

Competitive Audit

Alongside this research, we conducted a competitive analysis, examining the education-to-purchase journeys of 6 competitive offerings. We found patterns such as:

• Education content is primarily ‘bolted on’ to digital workflows

• A successful site connects the dots for me

• Choosing an agent adds to decision anxiety

• Complex decisions are more approachable when I’m not

making them alone.

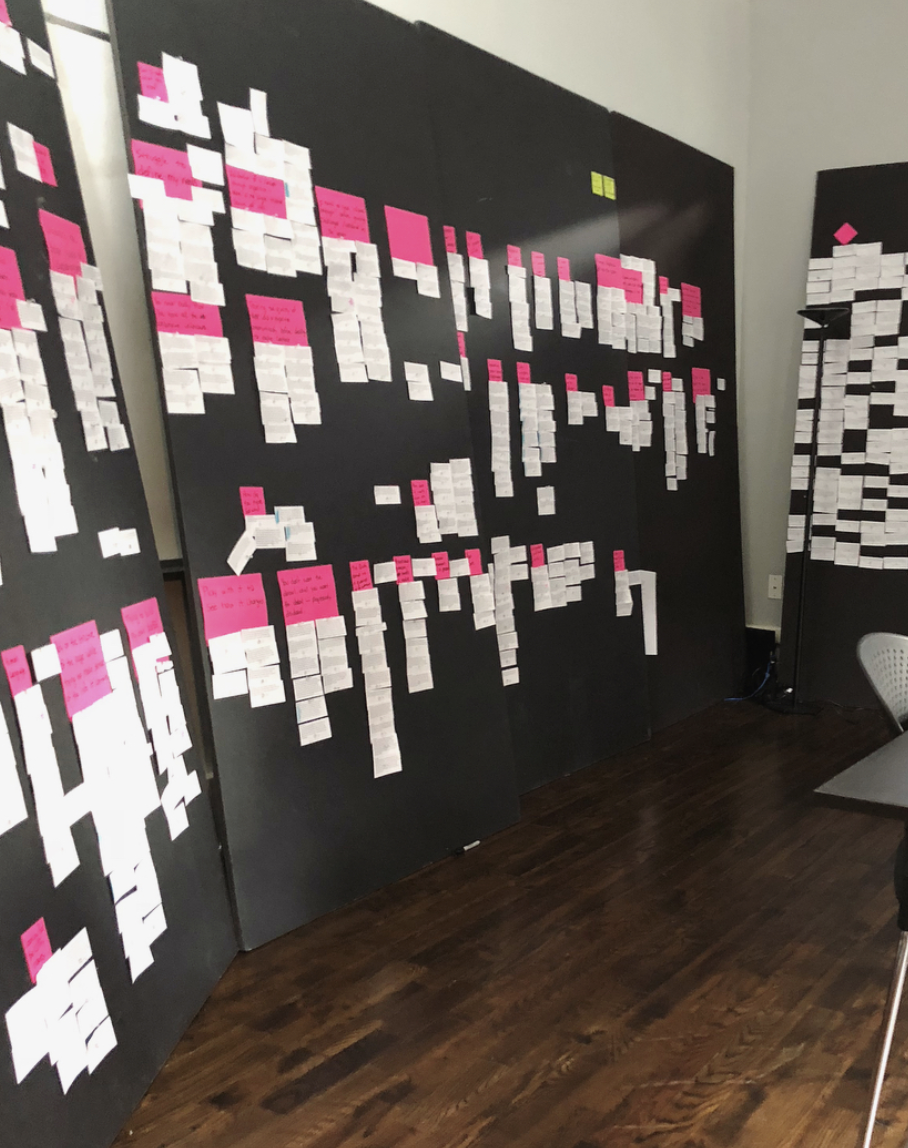

Synthesis and provocations

We then began to analyze the data we collected from the Diary Study and from our in-person interviews to extract meaning and insights.

We used this set of provocative concepts to seed our thinking about what could be possible for future customer journeys. We found a few key barriers that currently block prospects from engagement:

1. In the era of Google, a commissioned agent is no longer the source of truth.

2. There are no clearly perceived boundaries between product offerings - everything overlaps.

3. Repetition is the current “trusted source” of information.

4. Prospects will abandon providers for the slightest infractions.

7. The education demands of life insurance are too big to fit within the “in-between” time that prospects have to allocate.

8. There is no “education experience.” To prospects, there is a single journey that moves from introduction to purchase.

2. There are no clearly perceived boundaries between product offerings - everything overlaps.

3. Repetition is the current “trusted source” of information.

4. Prospects will abandon providers for the slightest infractions.

7. The education demands of life insurance are too big to fit within the “in-between” time that prospects have to allocate.

8. There is no “education experience.” To prospects, there is a single journey that moves from introduction to purchase.

“Am I asking the right questions, but using the wrong words? That is even more frustrating.”

“It just feels like there is so much unknown that it’s probably available out there to find, but it just feels like it’s a whole black box of something you need to figure out.”

Understanding the customer journey map

We identified four distinct education journeys within the current customer experience.

After learning what journeys prospects currently experience before and on our client’s site, we needed to understand what journeys prospects wish they could have, why, and how.

Concept sketching

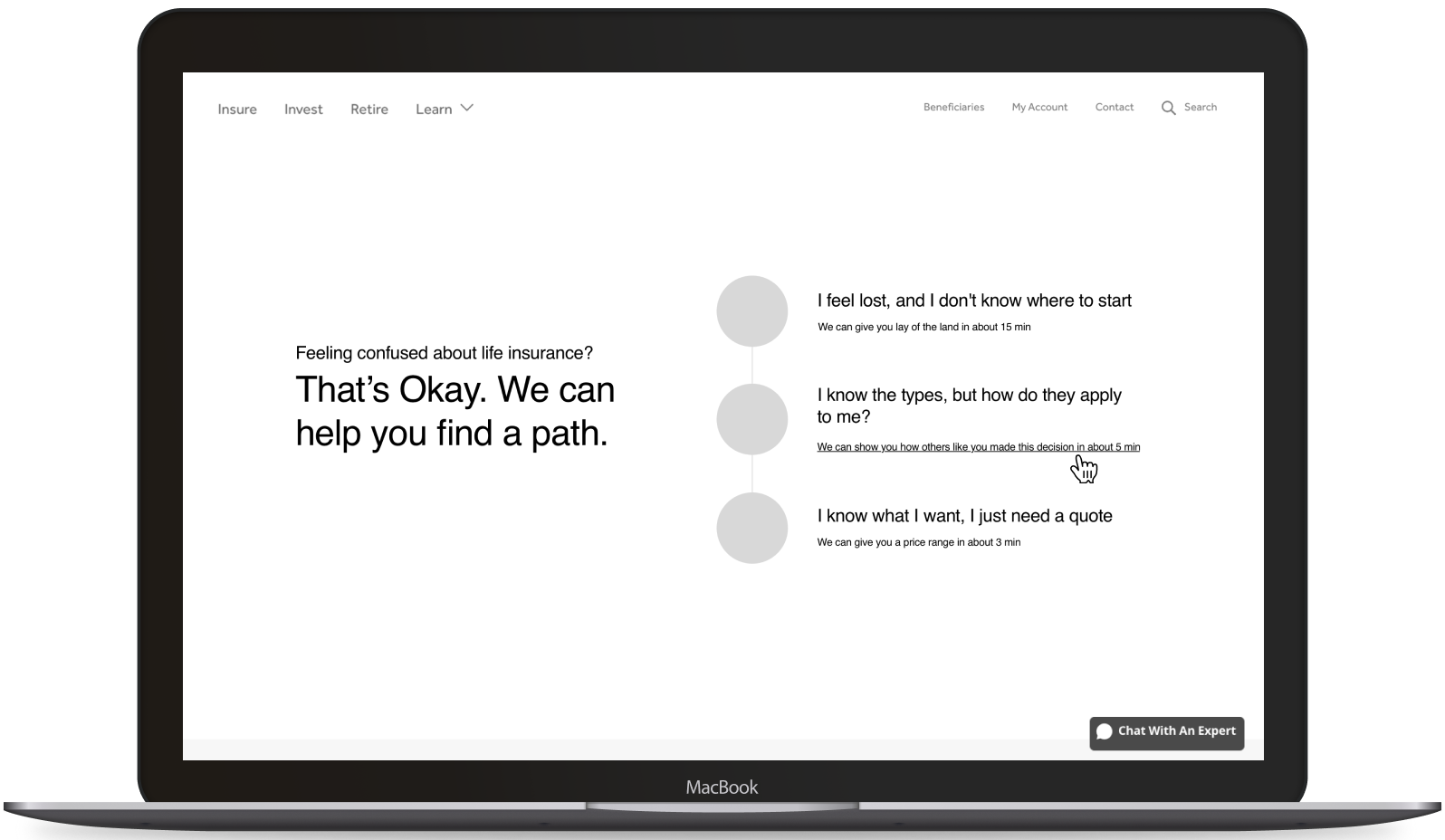

Our next step was to create mid-fidelity concept sketches of varying degrees of provocation representing unique approaches to moving prospects forward in the education journey.

Below are the concepts that I created, represented as wireframes.

Mid fidelity concept sketches

We iterated on these concepts with our client’s core team and identified primary capabilities required to support these experiences. We then brought the concepts up in fidelity to put in front of users for validation.

Concept validation

Our methodology for concept validation leveraged a mid-wireframe prototype, using Marvel, to extract observations and feedback around what participants saw and experienced.

We conducted testing with 10 participants and focused our questions on actual behavior, comprehension and sentiment by asking questions such as, “How do you feel about what you see?”

Overarching findings

After synthesizing the data collected from testing, we used key takeaways to revise our hypothesis about the ideal journey's flow. Here were some of our findings:

• The ability to choose a path that aligned to a prospect’s own view of their understanding resonated with every participant.

• A 10,000ft introduction to life insurance is missing.

• Prospects needed a general ’ball park’ price range to narrow their options earlier than expected.

• Prospects are looking for qualitative stories from other people in order to vet agents.

• Prospects were ready to provide personal information when the value exchange was clear.

“ I would want to see, for example, it might cost you this much per month. Just to have some sort of idea of it, so I’m not expecting one thing and got another.”

“I just don’t like charts. Just tell me what it is…I just want a basic explanation. If I’m purchasing now, just tell me what it is. Just tell me.”

Future State Customer Maps

Based on what we learned from testing, we adjusted our concepts and captured the capabilities required to deliver this experience. We then developed hypotheses on the ideal state customer journeys we anticipated it creating and visualized these experiences in journey maps.

Moving Towards Capabilities

With an outline of the ideal journey, we articulated the flows and capabilities needed to enable and power that idealized journey to fulfill the needs of prospects. We provided a set of features or capabilities for an initial MVP, aimed in the direction of a larger vision, to then be iterated upon and tested, indicating ways to extend the design through a curated backlog. Here are some of the capabilities suggested:

1.

Scenario customization: The ability to completely customize the storyline makes the experience feel personal.2.

Compare Chart: A rich comparison chart helps prospects understand the distinctions between policies quickly, and is easy to implement.3.

Agent Callback: Prospects are able to enter basic information about themselves (including their contact information, when they are available, where they are in the life insurance journey, and when they would like to be contacted) and an agent will call them back.

Go-Forward Designs

After meeting with our client’s core team to identify challenges towards realizing these capabilities and consolidating on vision, we finished the project by providing a Go-Forward Engagement Design, which included:

1.

Wireframe flows that illustrate each prospect path from the home screen starting point

2.

A detailed future state customer journey map that illustrates the movement between these components (shown above in Future State Customer Journey Maps)

3.

A storyboard that captures the end-to-end prospect experience (starting at Google and ending at the policy), which includes idealized versions of agent interactions.

4.

A straw man v1 roadmap for progressing towards the consolidated journey.